The 10x Advantage: Crafting a Value Proposition That Sells Itself

I. Introduction: Why "Slightly Better" Is a Recipe for Failure

One of the most common complaints I hear from product creators is, "I can't get anyone interested in using my product." They've built something faster, cheaper, or with more features, yet it's met with a collective shrug from the market. When this happens, it often boils down to one of a few things: you might not be communicating the value effectively, the customer might not be ready to learn something new, or the sale might be too complex.

But the most common and uncomfortable reason is often the simplest: your product might simply not provide the value you think it does. It might be a lukewarm business solution or consumer product. Sure, it would probably be nice, and yeah, it sounds good, but it stands a good chance of simply not being a priority if it's not solving an immediate, compelling, and valuable issue.

A great example is painkillers versus vitamins. When someone has terrible pain, they will do almost anything for relief. Price may even become secondary to solving the issue quickly. On the other hand, a vitamin is something that we all realize is probably good for us, but how often do you find yourself in such desperate need of one that price is no obstacle?

To break through the noise and overcome customer inertia, your product can't just be a vitamin. It needs to be a painkiller. It can't just be slightly better; my favorite rule of thumb is that your solution must be fully 10x better than any alternative. This isn't just about features—it's about the total, perceived benefit to the customer. To understand that benefit, you need a structured way to map it out.

II. The Product Value Map: A Formula for Benefit

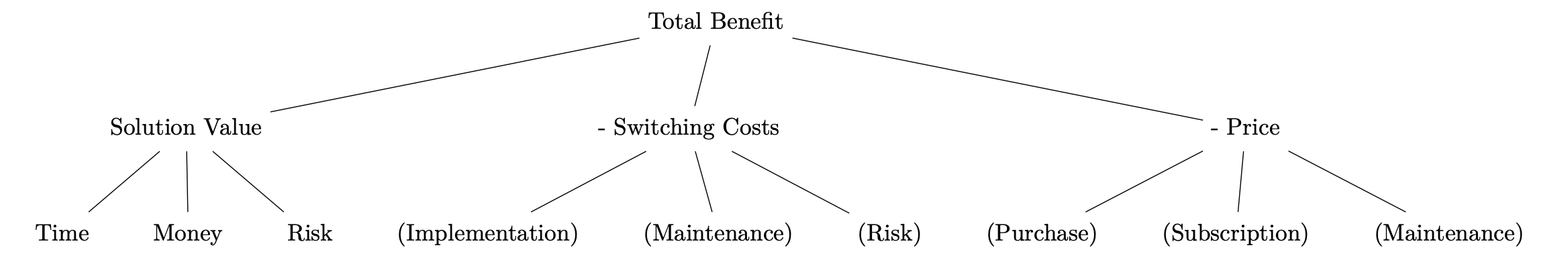

The Value Proposition, or "Value Prop," is a blanket term that covers all of the benefits that a customer would receive from using your product. To truly understand it, we need to break it down with a simple but powerful tool. I call it the Product Value Map.

The principle at work is to ensure that the whole is entirely represented by a sum of its parts. In the business consulting world, this is called MECE (Mutually Exclusive and Collectively Exhaustive).

At the highest level, the equation is:

Benefit = Solution Value - Switching Cost - Price

Let's break down these components.

- Solution Value: This is the total upside your product delivers. It’s the sum of all the savings and gains across dimensions like money, time, risk, and even ethics. It's the new roof that prevents costly repairs, or the new machine that doubles a business's output.

- Switching Cost: This is a container for every single direct cost, aspect of friction, confusion, risk, or other negative associated with the entire process of acquiring, implementing, and operating the new product. Think for a minute about all the things that a customer would have to do to get the benefits of your product. They have to spend time in a sales process, pay money, incur labor costs from their employees thinking about and selecting it, installing it, and changing their business processes to incorporate it. There's a risk premium here, too, as the customer can never be entirely sure how big these costs will be beforehand.

- Price: This is what you charge for the product.

Thinking through all the challenges your customer might face gives you insights into your product's true value and might tell you why people aren't as interested in it as you'd hoped. Customer perception dominates this equation.

III. A Case Study in Value: The TimberTinker Story

This might seem abstract, so let's walk through a concrete example.

Let's pretend that you have decided to start a timber supply business. Your potential customer is a factory, TimberTinker, that turns trees into toys. For the last fifty years, they've kept a six-month supply of logs on their 5-acre lot to guard against seasonal supply chain issues. Now, they need to expand the factory, but the land in their area is expensive.

Your company approaches them with an innovative offering: a Just-In-Time (JIT) logistics service. You claim you can deliver each week's production needs just the week before, allowing TimberTinker to free up most of their 5-acre lot for the factory expansion. To do this, you'll need to integrate with their Production Planning IT system.

You've turned a commodity (timber) into a service-coupled product that could deliver amazing value. But the value is entirely dependent on who you talk to.

Perspective 1: The Plant Manager (The User)

You make your sales pitch to the Plant Manager, whose primary concern is keeping his well-oiled machine running smoothly. His view of the Value Map looks like this:

- Solution Value: He sees some upside. He can avoid buying 2.5 acres of land at $25k per acre, for a total benefit of $62,500.

- Switching Costs: These are huge in his eyes. He estimates the IT integration will cost $13,000. He budgets $50,000 over five years for ongoing IT support for this new, fragile system. Most importantly, he's now dependent on a brand-new startup for his core raw material. He assigns a $5,000 risk premium to the chance of a delivery failure. His total switching cost is $68,000.

- Price: You offer the service for $3,000 over five years.

The Plant Manager's Calculation:Benefit = $62,500 (Value) - $68,000 (Switching Cost) - $3,000 (Price) = -$8,500

From his perspective, your product has a negative benefit. He sees all the risk and disruption, and the value just isn't there to justify the conversation. It's a "no."

Perspective 2: The CFO (The Economic Buyer)

As you're leaving, you run into the CFO. She sees the world through a different lens. What the Plant Manager didn't know is that the only nearby lot for sale is 20 acres for $500,000, and building on a separate site would require a new truck and driver, costing another $450,000 over five years. She also sees a huge risk reduction by not having to engage in a complex real estate transaction.

Her view of the Value Map is dramatically different:

- Solution Value: She sees the direct cost avoidance of the new lot and truck ($950,000). She adds another $65,000 for risk reduction and time savings. Her total solution value is $1,015,000.

- Switching Costs: She accepts the Plant Manager's estimate of $68,000.

- Price: Seeing the immense value, you re-price your service at $6,000/month, or $360,000 over five years.

The CFO's Calculation:Benefit = $1,015,000 (Value) - $68,000 (Switching Cost) - $360,000 (Price) = $587,000

From her perspective, your product delivers over half a million dollars in net benefit. It's a painkiller for her biggest strategic headache. It's an immediate "yes."

IV. Conclusion: Find Your Painkiller and Your Champion

This case study illustrates two critical lessons.

First, the value of your product is subjective and depends entirely on the customer persona you target. The very same product was a low-value "vitamin" to the Plant Manager and an urgent "painkiller" to the CFO.

Second, the purpose of the 10x advantage is to create a massive buffer against the hidden costs of reality. The reality is that your solution might not be as good as you think, and the customer's switching costs will always be higher than you estimate. The 10x rule ensures that even after reality erodes your advantage, there is still a clear, undeniable benefit left for the customer.

Your job as a product creator isn't just to build a solution. It's to find the right customer, in the right context, who experiences your solution's value so powerfully that it becomes their painkiller.

This week, don't build a new feature. Instead, build a Value Map for your product from the perspective of two different customer personas. Where is the value weakest? And for whom is it a 10x advantage? That is where you will find your champion.